In modern times, traditional banking systems are gradually paving the way for more sophisticated, customer-centric solutions. Neobanks, the modern evolution of banking, are leading this change. These digital-only banks are revolutionizing the way we manage our finances. But how much does it cost to build an app like a neobank? This comprehensive guide will answer this question and investigate the factors affecting Neobank app development cost.

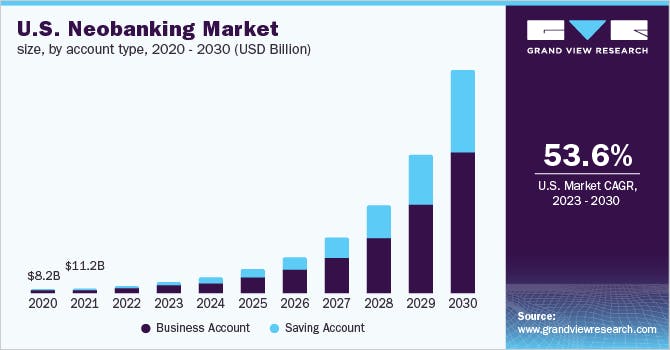

According to a 2022 report from Statista, the market size of neobanks in 2021 was reported to be around 47 billion US dollars. Not just that, the sector is expected to reach a value of 2.05 trillion US dollars by 2030 if it continues to grow at an annual average rate of 53.4%.

Another report from May 2022 stated that the number of people who have at least one account at a Neobank in the US is expected to peak at 39.1 million in 2025. These numbers will make sense only when you are familiar with the basics of a Neobank.

What is a Neobank?

A Neobank is a direct bank operating exclusively online without traditional physical branch networks. Neobanks offers a fully digital banking experience, providing services like checking and savings accounts, payment and money transfer services, loans, and more, all accessible via a mobile or web application. They often partner with traditional banks for regulatory purposes but provide a more user-friendly, tech-forward banking experience.

Benefits of Neobanking

Neobanks offer numerous advantages over their traditional counterparts:

Convenience: Neobanks allows customers to conduct banking transactions 24/7 from anywhere, providing a high level of convenience.

Speed: Due to their automated processes, transactions, account openings, and loan approvals are typically faster with Neobank.

Lower Fees: Neobanks often charge lower fees than traditional banks as they have less overhead due to the absence of physical branches.

Innovative Features: Neobanks offers cutting-edge features such as real-time notifications, budgeting tools, and AI-based financial advice.

Factors Affecting Neobank App Development Cost

The cost to build an app like a Neobank can vary significantly based on several factors:

Complexity of the App

The app's complexity greatly impacts the cost. A basic app with simple features will be less expensive than one with advanced features like AI-driven recommendations, multi-currency support, and real-time analytics. Digital

Discover More: Ecosystem for Banking Innovation

Design

A well-designed app enhances user experience and engagement. However, complex designs involving animations or custom illustrations can increase the cost.

Region of Development

The region where the app is developed also affects the cost. Developers in North America and Western Europe typically charge higher rates than those in Eastern Europe or Asian countries such as India.

Development Team

Choosing between a freelancer, a small app development firm or a prominent mobile app development company can significantly affect the cost. While freelancers offer lower rates, they may lack the breadth of experience a company provides.

Maintenance and Updates

Post-launch application maintenance and updates are essential and should be factored into the overall cost.

Primary Features of a Neobank App

A typical Neobank app should include the following primary features:

User Registration and Authentication: This feature ensures secure user registration and login. Integration with biometric authentication like fingerprint or face recognition can enhance security.

Account Management: Users should be able to check their balance, view transaction history, set up savings goals, and manage their account settings.

Money Transfers and Payments: The app should facilitate easy money transfers between accounts and payments to businesses.

Customer Support: A chatbot or live chat feature can provide instant customer support.

Notifications: Real-time transaction notifications, low balance alerts, and bill reminders improve user engagement.

Security Features: Two-factor authentication, encryption, and fraud detection mechanisms are some of the features critical for securing user data and transactions.

The Final Note

To build an app like a Neobank, you might need to pay anywhere from $35,000 to $300,000, depending on the abovementioned factors. The wide range is due to the varying complexity of features, design elements, and the choice of app development partner. Working with a reputable mobile app development company ensures you receive expert guidance throughout the development process, enhancing the chances of creating a successful Neobank app.

Remember to account for hidden costs such as third-party integrations, backend server costs, and post-launch maintenance and updates when budgeting for app development. These are critical elements to ensure the app's smooth operation and longevity.

Building a Neobank app is a considerable investment but offers immense potential. The increasing popularity of digital banking suggests a promising market for these platforms. Additionally, by offering customers innovative features, accessibility, and a user-friendly interface, Neobanks can help bridge the gap between traditional banking systems and the digital age.

To sum it up, the cost of building a Neobank app is a substantial investment that involves various factors. However, by choosing the right mobile app development company and planning wisely, you can create a robust, feature-rich Neobank app that provides value to users and stands out in the competitive fintech market.